Analysis of Developments in the Space Domain

9 Mar 2023: China launched a Long March 4C rocket from Taiyuan containing the Tianhui-6 A/B satellites. The Tianhui-6 twin satellites will be used for geographic mapping, land resource surveys, scientific experiments, and more. Some Western observers believe these functions are also utilized by the Chinese armed forces for military purposes. Launch Video.

– Tianhui translates to “sky-drawing” and is a series of unclassified cartography satellites operated by the China Aerospace Science and Technology Corporation (CAST).

– The two satellites launched to an 888×880km orbit with an inclination of 99°.

– The Tianhui-6 satellites are operating at an altitude far higher than predecessor Tianhui satellites.

– The 4 Tianhui-1 (1, 1-02, 1-03 and 1-04) family of satellites are operating at apogee values between 485-496 km. The 4 Tianhui-2 satellites are operating at apogees of 513km.

– Tianhui-1 satellites are equipped with three separate Earth observation cameras: a panchromatic camera with a spatial resolution of 5m, a panchromatic CCD camera with a spatial resolution of 2m, and a multi-spectral imager with a spatial resolution of 10m.

– Tianhui-2 satellites are China’s first microwave surveying satellite system based on synthetic aperture radar technology. TH-2 satellites operate in the X-band, with the resolution of 3m.

– Tianhui-1 satellites are operating independently, each in its own plane. Tianhui-2 satellites operate in formations of 2. Tianhui-6 A/B appear to be following the Tianhui-2 pattern and are also likely SAR capable, although operating at ~900kms is not typical for this mission type.

– For example, known Yaogan SAR satellites operate with apogees between 484-694km and Gaofen SAR satellites range 626-749km. Commercial SAR imager Capella operates satellites between 399-491km.

China has not released much information on Tianhui-6 satellites, however Chinese officials said the Tianhui 2 satellites are similar to the German TerraSAR X and TanDEM X radar observation satellites. The use of two satellites flying in formation yields stereo data critical to generate 3D maps. Tianhui 6 (assuming it is SAR) and Tianhui 2 radars complement the optical Tianhui 1 imaging satellites with a similar 3D mapping mission. The optical satellites are sensitive to spectral differences, allowing users to determine information related to vegetation and agriculture, land use, and natural resources.

11 March 2023: While a Chinese spy balloon crossing the northern tier of the US captured the fascination of many, another Chinese object parked over the US’s (and Canada’s for that matter) geographic center line since early Nov. Little is known about China’s TJS-7 spacecraft, other TJS labeled spacecraft are believed to be SIGINT collection platforms while others are thought to be Early Warning satellites similar to the US Space Based Infrared System (SBIRS). What is known is that TJS-7 is now parked at 99.6° west longitude. It is the only Chinese GEO satellite over the western hemisphere.

-TJS-7 launched on 24 Aug 2021 on a LM-3B from Xichang. Launch VIDEO.

-TJS-7 transitioned from GTO to GEO around 9 Sep 2021 and settled into 146.5°E (North of Papua New Guinea). It remained in this location for over a year.

-In late Oct 2022, TJS-7 decreased its Semi-Major Axis (SMA) 332.3km and driftied East. TJS-7 maintained its drift for most of Nov, rejoining the GEO belt around 26 Nov 2022.

-TJS-7’s new position as of late Nov was 99.6° W longitude which is centered on the continental US. – The maneuver from 146.5° E to the 99.6°W location (113.9°) equates to roughly 84,000km at GEO where 1°~735km.

-The new location seems to support either the SIGINT or missile warning missions suspected of the other TJS satellites. However there is little information available and TJS-7’s mission could be completely different.

-There is open source reporting TJS-7 will carry out a docking experiment with TJS-6. TJS-6 is currently the closest Chinese GEO satellite to TJS-7 at 178.4°E, a distance of 82° or ~60,000km.

–TJS-2, 5, 6 and 7 were all built by SAST and are believed to be part of China’s Huoyan missile

warning constellation. TJS-1, 4 & 9 were built by CAST and are believed to be SIGINT satellites. All of this information is unconfirmed.

-Also unknown is how TJS-7 is sending its data back to China as it is well out of range of any ground stations based in China. It likely is passing data through one of the Tianlian-2 relay satellites or perhaps to a Chinese built ground stations in South America.

-Tianlian 2-02 is the nearest relay satellite and is located at 171°E, 89.4° away from TJS-7.

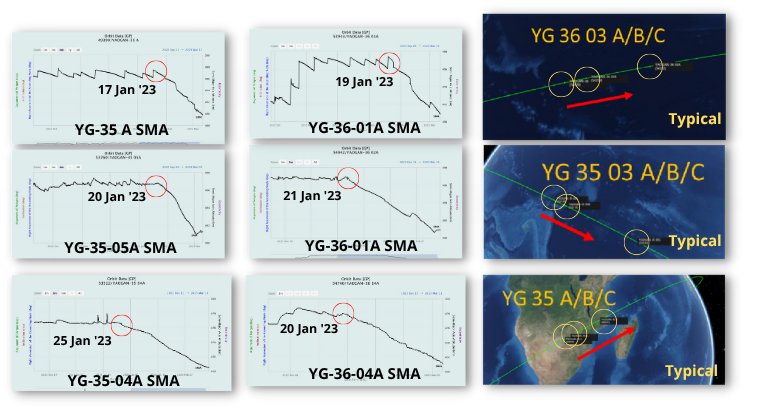

10 Mar 2023: Following on from the previous FFF edition, it appears all 27 Yaogan-35 (15) and Yaogan-36 (12) satellites continue reducing their altitudes. The Yaogan-35-2 (YG-35-2) formation is the most abnormal with its trio of satellites increasingly spread apart. The YG-36-01 formation has also changed. Instead of one lead

satellite and two in trail, this trio has 2 satellites

in lead with one in trail.

– On average YG-35 satellites have reduced their SMAs 7.3km, YG-36 satellites have reduced their SMAs 7.0km.

– It appears that all began to reduce their altitudes at around 17-27 Jan 2023.

– All formations continue to reduce their altitude, however 5 of the trios have briefly increased their SMAs only to resume their controlled descent.

– The patterns suggest this is a planned SMA alteration for all of the formations with the possible exception of YG-35-02.

-China is likely adjusting various aspects of the YG-35 and 36 constellation and developing new tactics, techniques and procedures to maximize the effectiveness of each satellite as well as the synergy of the three satellites working together.

– As of 12 Mar 2023 all satellites continue to decrease their SMA.

27 Feb 2023: Two articles focused on China’s attempts to develop a proliferated Low Earth Orbit (pLEO) communications constellation to counterbalance SpaceX’s Starlink. There is also an awesome 10 min Video which is worth your time!

– The rise of Starlink has established LEO broadband constellations as strategically important infrastructure that other countries want, if they can justify it.

– There has been high-level support for broadband constellations in China, however tangible action has been limited. In 2023 this might start to change, with several pieces of a complex puzzle coming into place in China’s long journey towards fielding an answer to Starlink.

– Starlink-like LEO broadband internet constellations may be a modern-day equivalent to what GPS was in the 1980s and 1990s—technology with uncertain, but undeniably important future applications in commercial and military applications.

– Just after Starlink started to accelerate its deployment cadence (Apr 2020), China’s National Development and Reform Commission (NDRC) added satellite internet the the list of New Infrastructures.

– A few months later, Galaxy Space raised a new round of funding touting plans to build a “Chinese version of Starlink.” Two months later (Feb 2021), fellow satellite manufacturer Commsat raised ¥100M from the state-owned China Internet Investment Fund (CIIF), with plans to develop strong capabilities in satellite internet.

– On 29 Apr 2021, China’s State-Owned Assets Supervision and Administration Commission (SASAC), a national-level body overseeing China’s ~100 largest state-owned enterprises, made a major announcement: the establishment of China Satellite Networks Group Limited (中国卫星网络集团有限公司, “China SatNet”)

– While the constellation size and scope are still not entirely clear, earlier ITU filings made by China, and later published in an article (since deleted), seem to indicate up to ~12,992 satellites.

– Question: in a country with a very strong fiber network, with extremely low purchasing power for the few % of the population living outside the fiber network, and with a relatively limited overseas presence, what’s the need for this type of constellation?

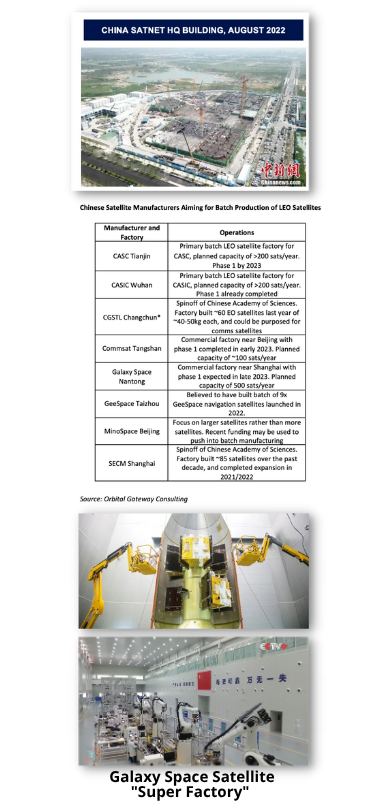

– There are no less than 7 companies in China building satellite factories with planned capacity of ~100-300x satellites per year of ~100kg mass class. Most of these factories are in advanced stages of completion, and some (CASIC Wuhan, CGSTL) were completed.

– Likely that commercial manufacturers will continue to launch small batches of their own satellites and test their technology while also

demoing their capabilities.

– We should expect to see a few more batches of LEO comms satellites

launched by China in 2023, whether by nominally commercial companies or by pure-play SOEs, and these launches will likely serve as a precursor to accelerated deployment of China SatNet and its constellation.

27 Feb 2023: Richard DalBello, director of the Office of Space Commerce (OSC), last week told the National Space Council’s User Advisory Group (UAG) his office faces five key challenges that he is hopeful the group’s members can help resolve.

1. Space Situational Awareness (SSA) Shortfalls: the most immediate issue is related to the Commerce Department’s long-planned takeover of the Pentagon’s space situation awareness (SSA) responsibilities — which involve tracking satellites and dangerous space junk, and providing warnings of potential on-orbit collisions — to non-military operators.

-“Today, SSA is pretty good. It’s not uniformly excellent. This means that the government is sending out a lot of warnings to industry that get ignored,” he explained. “We need to be able to speak with the same confidence in SSA that we speak with air traffic control.”

2. International Woes: “China is a major space player and will be a major space player. They are not participating in the global dialogue, and in global information sharing on SSA. That’s unsustainable,” DalBello said. “The current way of communicating with China, which is by email and the occasionally tersely written démarche, is comically insufficient. And so, major problem.”

3. Do No (Economic) Harm: “We’ve been asked to to implement an SSA system, but because the current system isn’t meeting all the needs of the commercial sector we have a whole commercial industry that’s that’s sprung up and is providing additional services. And so part of the challenge for the Department of Commerce is: ‘how do we come into this marketplace and not disrupt it entirely?’ Because when the government enters the marketplace, as the principal buyer, we have a hugely disruptive impact.”

4. Regulations: Who, what, how

A number of US firms are pursuing types of activities on space — including a number of things of interest to the Defense Department, such as on-orbit servicing — that today fall through the regulatory cracks. “We have a lot of new activities — refueling and manufacturing in space, commercial [low Earth orbit] stations, mining on the Moon — we have a bunch of stuff coming at us [that] we’re not really yet poised to, the regulatory regime isn’t really set up to, handle,” DalBello said.

5. Operator Responsibility: Do the Right Thing

“We need to work on the development of, as I call it, a concept of ‘operator responsibility,’” he said. “We are slowly moving out on things like safety, debris mitigation, adherence to best management manufacturing practices, the overall rubric of sustainability. … but we really haven’t had a whole of government, really deep think about how where we want to go on this.”

9 Mar 2023: The US Director of National Intelligence released the 40 page unclassified Annual Threat Assessment. Space was a specific topic for both China and Russia. Excerpts below.

China is steadily progressing toward its goal of becoming a world-class space leader, with the intent to match or surpass the United States by 2045. By 2030, China will probably achieve world-class status in all but a few space technology areas. China’s space activities are designed to advance its global standing and strengthen its attempts to erode U.S. influence across military, technological, economic, and diplomatic spheres.

China’s commercial space sector is growing quickly and on pace to become a major global competitor by 2030. Beijing’s policies to encourage private investment in space activities influenced a broad range of firms to enter the commercial market.

Counterspace operations will be integral to potential PLA military campaigns, and China has counterspace weapons capabilities intended to target U.S. and allied satellites. The PLA is fielding new destructive and nondestructive ground- and space-based antisatellite (ASAT) weapons.

Russia will remain a key space competitor, but may have difficulty achieving its long-term space goals due to the effects of additional international sanctions and export controls following its invasion of Ukraine. Additionally, a myriad of domestic space-sector problems, and increasingly strained competition for program resources within Russia constrains their future ambitions.

Moscow will probably focus on prioritizing and integrating space services — such as communications; positioning, navigation, and timing; geolocation; and intelligence, surveillance, and reconnaissance— deemed critical to its national security.

Russia trains its military space elements, and field new anti-satellite weapons to disrupt and degrade U.S. and allied space capabilities. It is developing, testing, and fielding an array of nondestructive and destructive counterspace weapons—including jamming and cyberspace capabilities, directed energy weapons, on-orbit capabilities, and ground-based ASAT capabilities—to try to target U.S. and allied satellites. Similar to the space sector, resource and technology challenges could have an impact on the quality and quantity of Russia’s future counterspace capabilities.

Russia is investing in electronic warfare and directed energy weapons to counter Western on-orbit assets. Russia continues to develop ground-based ASAT missiles capable of destroying space targets in low Earth orbit.

23 Feb 2023: Article from Yasuhito Fukushima describes Japan’s increasing efforts to acquire defense-related space capabilities.

– Japan Self-Defense Forces (JSDF) have been a user of space services, such as weather forecasting and satellite communications, for more than four decades, it was only after the enactment of the Basic Space Law in 2008 that the JSDF started to consider building its own space capabilities.

– Japan has planned and implemented dedicated space programs for defense purposes over the past decade.

– Japan’s Ministry of Defense (JMOD) launched two dedicated communications satellites in 2017 and 2018, respectively. While the private sector operates those satellites through a private finance initiative, they became the first satellites owned by the JMOD.

– In 2018 Japan positioned space as a new domain alongside the cyber and electromagnetic spectrum, prioritizing the investment of resources in those domains in order to achieve seamless cross-domain operations.

– In 2020, the Japan’s Air Self Defense Force (ASDF) created the Space Operations Squadron as the first JSDF unit dedicated to the space domain. In 2022, the ASDF established the Space Operations Group. The Space Operations Group is scheduled to start operating its space domain awareness (SDA) system utilizing a ground-based radar to surveil objects in geostationary orbit in FY 2023.

– Japan’s 2022 National Security Strategy refers to expanding the development of capabilities to hinder opponents’ space use, such as space-based command, control, communications, and information (C3I).

– The NSS also includes specified the construction of satellite constellations. These satellite constellations will be utilized for intelligence, surveillance, reconnaissance, and targeting (ISRT) to operationalize standoff defense capabilities.

– The JMOD/JSDF intends to remarkably expand the size and budget of its space-related organizations and programs. The NDS includes the restructuring and rebranding of the ASDF to the Air and Space Self-Defense Force.

– JMOD plans to allocate approximately one trillion yen (roughly 7.5 billion U.S. dollars) for space-related efforts over the five years commencing FY 2023, more than doubling the ministry’s annual space budget.