Analysis of Developments in the Space Domain

10 Oct: China launched a Long March-3B with WHG-03 (61503) (high-orbit internet services satellite) from Xichang. WHG-03 is currently in Geostationary Transfer Orbit (GTO) and will likely settle into its GEO slot in the next 2 weeks and join WHG-01 (59069) and WHG-02 (60327). China has released no details regarding the mission and capabilities for the WHG satellite series. Launch Video.

– WHG-03 is currently in a 35,780 x 199km orbit and is inclined 28.4°. This is similar to the profile of WHG-01 (59069) and WHG-02 launches. China has launched all WHG satellites from Xichang using the LM-3B.

– According to a November 2023 Xinhua report, the China Aerospace Science and Technology (CAST) Corporation had completed the first high-orbit satellite Internet. The report noted that the purpose of the satellites was to completely cover the entire territory of China and key areas along the “Belt and Road” countries.

– More information to follow in the coming weeks as WHG-03 settles into its GEO slot. I could not find any information regarding the ultimate GEO location for WHG-03.

– China placed WHG-01 in an interesting orbital slot…33.7°E is due south of Eastern Ukraine. Kharkiv is 36.3°E and Donetsk is 37.8° E. This would also be a good location for supporting “Belt & Road” initiative states in Africa and the Middle East as well as Western China.

– WHG-02 is in GEO stationary orbit over the Western Pacific at 153.1°E.

11 Oct: China successfully recovered its Shijian-19 (61444) (SJ-19) satellite at the Dongfeng landing site after 14 days in Low Earth Orbit. SJ-19 launched on a Long March-2D from Jiuquan on 27 September 2024 and, per official sources, is China’s “first reusable and returnable test satellite”. During its brief visit to space SJ-19 conducted several maneuvers, its final recorded apogee/perigee was 342x333km with an inclination of 41.6°. A statement from the China National Space Administration (CNSA) noted, “The recovery payloads on board, including plant and microbial breeding payloads, autonomous control and new technology verification test payloads, space science experiment payloads, social welfare and cultural creativity payloads, have all been successfully recovered.” CNSA went on to note, SJ-19 “achieved breakthroughs in key technologies such as reusability, lossless recovery, and high microgravity support. It has verified the technical indicators of the new generation of high-performance reusable returning space test platform and achieved various expected test results.

In his SpaceNews article, Andrew Jones noted the “mission also carries payloads from five countries, including Thailand and Pakistan…China has a strong interest in space breeding of crops. Exposure to space conditions is thought to accelerate genetic mutations that may enhance crop resilience and productivity. With relatively little arable land, China aims to increase crop yields and agricultural output.”

8 Oct: We took a look at the station keeping maneuver schedules for both Yaogan-41 (58582) and TJS-11 (59020) in the 21 July 2024 edition of the Flash. At that time the maneuvers appeared to be synchronized, potentially to maintain consistent orbit phasing for both spacecraft. Both satellites conducted 3 station keeping maneuvers between 19 July and 8 Oct 2024. On average the most recent 3 maneuvers occurred within 6.3 days of one another. The previous 5 maneuvers occurred an average of 2.6 days of one another. The satellites remain close in their relative orbital positions with YG-41 crossing the equatorial plane ~1hr 7min ahead of TJS-11. In mid-July YG-41 crossed the equatorial plane ~1hr 6min ahead of TJS-11.

– China launched Yaogan-41 on 15 Dec 2023 and it is believed to be an imagery satellite capable of 5m resolution.

– China launched TJS-11 on 23 Feb 2024 and its mission is unknown. Other TJS missions have been associated with missile warning, signals intelligence, and satellite inspection.

– China used its largest rocket, the LM-5B, equipped with an extended fairing for both launches.

– TJS-11 is located between Gaofen-13-01 (46610) (2.4° separation) and YG-41 (3° separation). Gaofen-13-01 is also a GEO imagery satellite.

– At 5.1° inclination TJS-11’s orbit is the most inclined of any of the TJS satellite family. YG-41’s orbit is inclined 4.4° which is greater than China’s other electro-optical GEO based imagers.

-The inclination of both satellites has declined 0.4° in the past 5 months. Decline appears to be natural orbit evolution.

– TJS-11 arrived in GEO 70 days after YG-41, and the two orbits appeared to track closely with one another from the start, with TJS-11 slightly trailing YG-41 as they completed their “figure 8” orbital pattern.

– The station keeping timing has diverged over the past 3 months going from an average difference of 2.6 days for the first 5 maneuvers to an average of 6.3 days.

-In spite of the growing timing divergence the orbit phasing remains nearly unchanged. YG-41 “led” TJS-11 by ~1hr 6min on 16 July 2024. On 8 Oct 2024 YG-41 was ~1hr 7min ahead of TJS-11.

– Station keeping maneuvers for both satellites are similar in magnitude, with TJS-11 decreasing its SMA an average of 3.3km and YG-41 decreasing its SMA an average of 3.8km.

12 Oct: The 9 YG-43 01 satellites (60458-60466) and 6 YG-43 02 satellites (60945-60950) appear to have assumed their operational configuration and spacing. Here’s a quick summary.

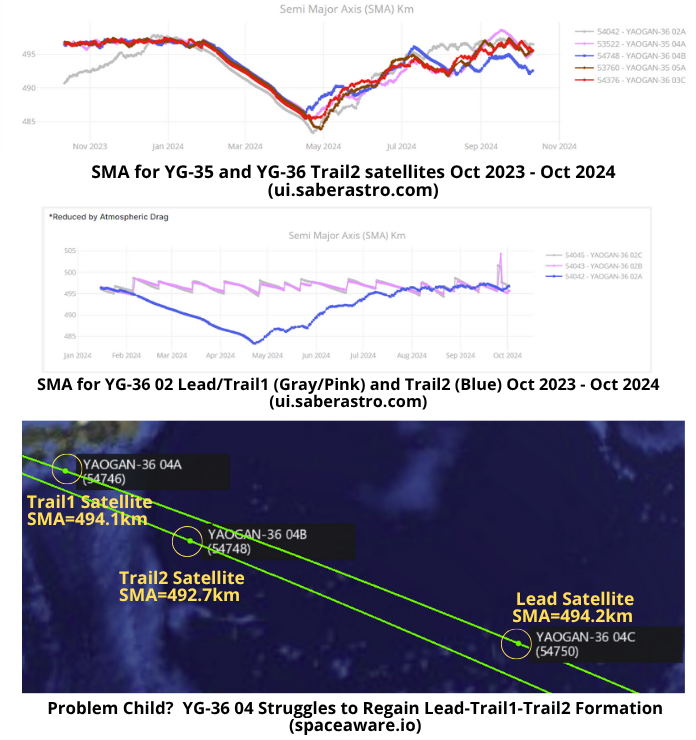

12 Oct: As we noted in the 24 March 2024 Flash China reduced the altitude of 7 of its Yaogan-35 (YG-35) and Yaogan-36 (YG-36) Trail2 satellites in late January 2024. Of those 7 formations, 4 (YG-35 04, YG-35 05, YG-36 02 and YG-36 03) have now been reconstituted with Trail2 satellites having a RAAN off-set from the Lead-Trail1 pair. Two of the formations have failed, YG-35 01 had its lead satellite die and YG-35 03’s Trail2 satellite appears to have also become non-responsive. Both are likely to re-enter in the next few months. The final triplet, YG-36 04 remains questionable with the Trail 2 satellite (54748) having recently decreased its SMA and is now 1.4km lower than the Lead (54750) and Trail1 (54746) satellites. As a result (10:1 rule again), the Trail2 satellite recently passed Trail1 and will pass the Lead satellite in the next week unless it increases its SMA.

30 Sep: In his most recent China Space Monitor newsletter, Blaine Curcio, takes a look at China’s evolving space supply chain. Blaine highlights that for new technologies (like inter-satellite laser links) innovative new companies are plentiful, while for older technologies (such as rocket engines) state-owned enterprises (SOEs) or their spin-off companies remain dominant with little competition. Excerpts below.

– Prior to 2014 almost everything was built by a large SOE (mostly CASC, and a few companies within CASIC, CETC, etc.) or specialty institutes of the Chinese Academy of Science (CAS).

– Within CASC are several “first-tier” subsidiaries…including the China Academy of Launch Vehicle Technology (CALT, aka 1st Academy), China Academy of Spaceflight Technology (CAST, aka 5th Academy), and the Shanghai Academy of Spaceflight Technology (SAST, aka 8th Academy).

– Typically the first-tier subsidiary builds the rockets and satellites, with second-tier making systems and subsystems, and third-tier making subsystems, materials, and components. (see graphic top right)

– For components or systems for which there is no established manufacturer…have, all else equal, seen a lot more investor interest, and in at least a few cases, a looming sense of overcapacity.

– For technologies…SOEs can already make, we have seen some commercial activity, but not an overwhelming amount. To take one example, rocket propulsion systems.

– The most successful commercial launch companies are buying rocket engines from CASC (solid rockets from 4th Academy, liquid from 6th).

-For technologies for which there was no well-established supplier…Private capital, and more recently provincial governments, have salivated at the prospect of all the lasers, hall effect thrusters that China’s large non-geostationary constellations will need.

– As recently as late 2019, there were almost no commercial companies in China developing laser communication terminals…Since early 2020, we have seen the establishment of HiStarlink, Laser Link, Laser Starcom, Shanghai Qionglong Science & Technology, alongside several CAS spinoffs.

2 Oct: The Center for Strategic International Studies (CSIS) released their analysis of publicly purchasable remote sensing data from different providers across metrics like ground sample distance, resolution, collection capacity, and revisit rates. The CSIS study is a follow-on to a 2021 report from the U.S. National Geospatial-Intelligence Agency (NGA) report which also compared the performance of commercial satellite imaging systems. CSIS’ 2024 results showed some improvement in US performance, however China won the most Gold Medals (5) and was on top of the total medal count (14). Excerpts below. Read full report.

– Of 11 performance categories, Chinese systems garnered the gold medal in five areas and U.S. systems in four areas, with Finland and South Korea each securing a gold medal.

– Nearly half of the podium spots went to satellite systems launched from 2021-2024, showing a large amount of dynamism within the last four years and the speed at which more advanced capabilities are being introduced in the global commercial marketplace.

– The 2024 winners spotlight the continued advancement of China’s remote sensing capabilities and the expansion of its commercial space sector. Commercial remote sensing is one dimension of a broader space competition as Beijing continues to execute its vision of leading the world in space, among other key technology sectors.

-The assessment covered 11 categories of performance across electro-optical (EO), synthetic aperture radar (SAR), and infrared (IR)

modalities. 9 categories are similar to those used by NGA in 2021, and two categories have been added…The research team did not contact Chinese system owners, which could introduce both favorable and unfavorable effects for Chinese systems in the rankings.

– The Most notable in the EO categories is China’s rise to gold in EO imaging capability, with its SuperView Neo-1 system, launched in 2022, offering a commercial product that combines high-resolution imagery with the largest constellation collection capacity…Jilin-1 EO systems hold the top spot in EO revisit, owing to its large constellation of over 100 operational satellites in orbit.

– SAR X-band imaging performance saw a complete shake-up on the podium this year, with the three medalists being all new systems—U.S. Umbra SAR (gold), U.S. Capella Space Acadia (silver), and Finnish ICEYE Generation 3 (bronze)—launched in the 2022–2023 timeframe…Chinese firms have made less progress in X-band SAR, they lead the pack in C-band SAR. C-band SAR provides lower-resolution radar imagery over larger areas.

-In the category of long-wave infrared (LWIR), Chinese commercial systems are dominant… Changes to U.S. regulatory restrictions on infrared imaging will enable U.S. companies to test this commercial market, with two U.S. companies planning to launch systems in 2025.

Should any one country dominate the commercial remote sensing market, not only could it gain economic advantages, but it would also control the information narrative about the entire planet, from the environment to natural resources to human conflict.